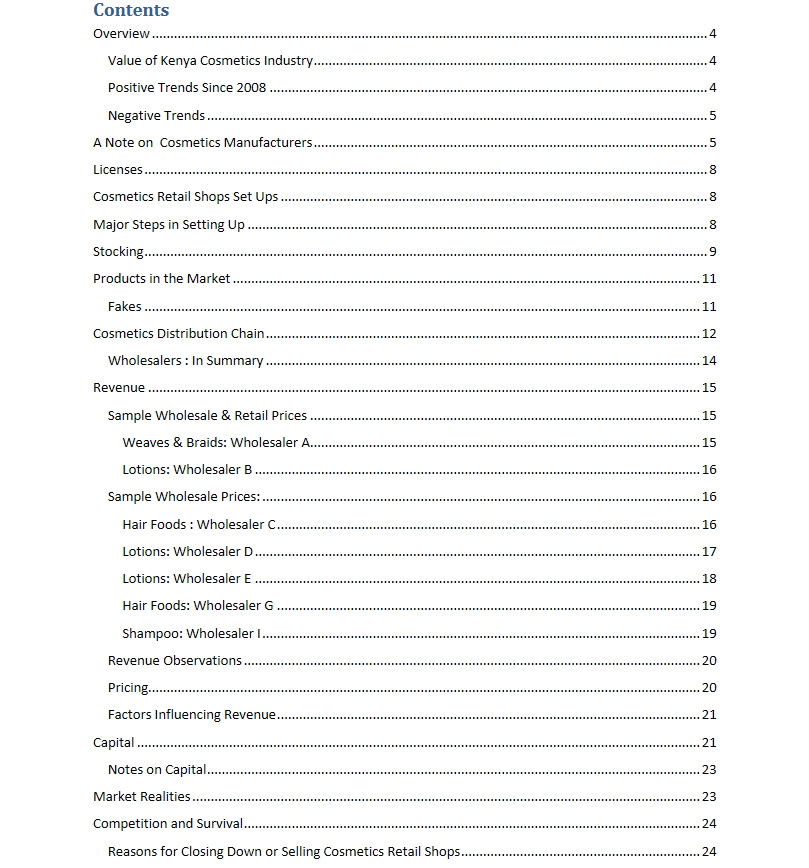

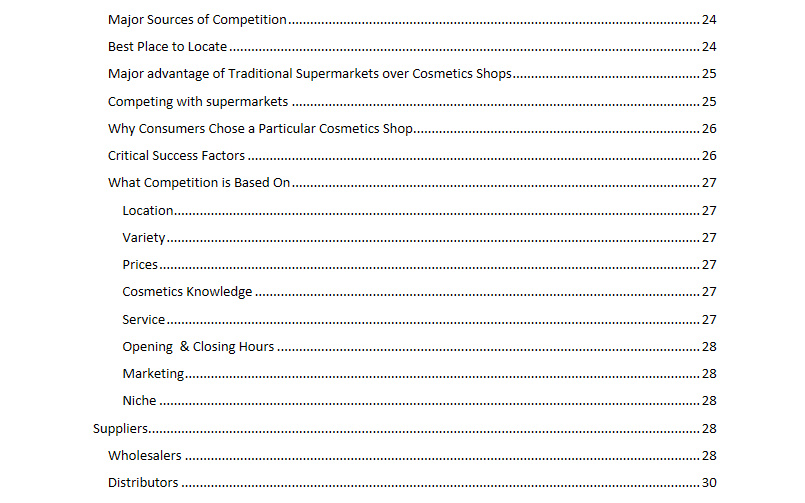

Cosmetics Retail Business Plan

Cosmetics Retail Business Plan

Cosmetics Retail Business Plan Overview

This Cosmetics Retail Business Plan focuses on the retail of beauty and personal care products commonly referred to as Cosmetics Retail Business.

Value of Kenya Cosmetics Industry

The Kenyan Cosmetics industry is estimated to be valued at least Kshs.100 billion (2016). This is the value of cosmetics goods sold and distributed in the country. The value is the accepted estimate quoted by the Kenya Association of Manufactures, Kenya National Bureau of Statistics (KNBS), and even multinationals such as L’Oreal and P&G. In 2011 KPMG, a consultancy, estimated the value to be Kshs. 20 billion.

The exact value of the industry is not known. This is because of the high number of cosmetics traders operating informally: from those illegally importing products to backyard manufacturers who are not documented. Thus the value could exceed Kshs. 100 billion.

Cosmetics Retail Business Positive Trends Since 2018

- Increase in indigenous cosmetics brands.

- Increase in training on cosmetics making.

- No of traders selling small scale cosmetics items has increased.

- Small and large scale independent importers of cosmetics products have increased.

- Middle class expansion and with it socially conscious woman with money to spend.

- Increase in the number of career women.

- Social competition and pressure.

- High end international brands establishing a formal local presence. These include Mac, Black Opal, Essie Nails, Estee Launder and more.

- Studies by Consumer Insight, since 2013, which show that the Kenyan woman prioritizes spending on cosmetics before saving, paying rent or even paying school fees.

A Note on Cosmetics Manufacturers

Other than Cosmetics Retail Business you can join the Kenya cosmetics industry at two other major levels:

Cosmetics manufacturers can be grouped into large, medium and small depending on their market size.

Among the large manufacturers are the multinationals with a local presence. The local presence of the manufactures is through manufacturing and distribution channels established from scratch or by acquiring stakes in indigenous companies.

The biggest acquisition of an indigenous company by a multinational has been the Kshs.3 billion purchase of Inter-consumer Products, who owned the Nice & Lovely brands, by L’Oreal of France in 2012. L’Oreal was targeting the Kenyan mass market and Inter-consumer’s established distribution systems.

Then there are the medium size manufacturers, most of them indigenous. They make a variety of skin and hair products. A number of these companies have turnovers in hundreds of millions.

Whereas some of the medium sized manufacturers have well known products, others operate below the radar with no particular product standing out but nevertheless selling big numbers. These include Triclover Industries, Uzuri, Alison Products, and Nightrose Cosmetics among others.

In this group are also large scale importers bringing in a variety of cosmetic products.

Lastly are the small manufactures that are working or struggling to get a share of the market. The more successful of them are competing with the medium and large manufacturers for shelf space in the supermarkets.

By our research since 2011 there has been a surge in the number of entrepreneurs interested and actually making cosmetics products. Part of the interest was triggered by the much publicized acquisition of the cosmetics division of Interconsumer Products by L’Oreal. The small and backyard beginnings of Paul Kinuthia, Interconsumer Products founder, have enticed many to try start their own cosmetics lines hoping to replicate his magic.

The new crop of small cosmetics manufacturers can be grouped into: professional manufacturers with some capital to buy equipment, hire professionals and do some branding. And ‘bathroom’ manufactures who mix chemicals in their houses to make products like hair shampoos, lotions and soaps.

Of the professional group some are niche targeting a very high end market with exclusive cosmetics lines like Suzie B and IMAHA which can cost as much as Kshs.30,000. The rest, who are the majority, aim for the mass market. These include the many no name products and also the likes of Tony Airo and Melrose Bounty and Brown and. There are also some entrepreneurs contracting companies in China and even locally to manufacture and package cosmetics.

Ideally to start a Cosmetics Retail Business the first thing that is needed is the formula to make the product. Now in the market are products made from original formulas, products made by cloning the formulas of popular brands, products made what we could call mass formulas, common knowledge formulas that are open to everyone.

Despite the challenges some of the small manufacturers are gaining ground by persistence, innovation in products, distribution and marketing. The latter is partially by selling directly to consumers, having product ambassadors in salons and other social setting, focusing on small supermarkets and aggressive marketing.

Download Cosmetics Retail Business Plan / guide here