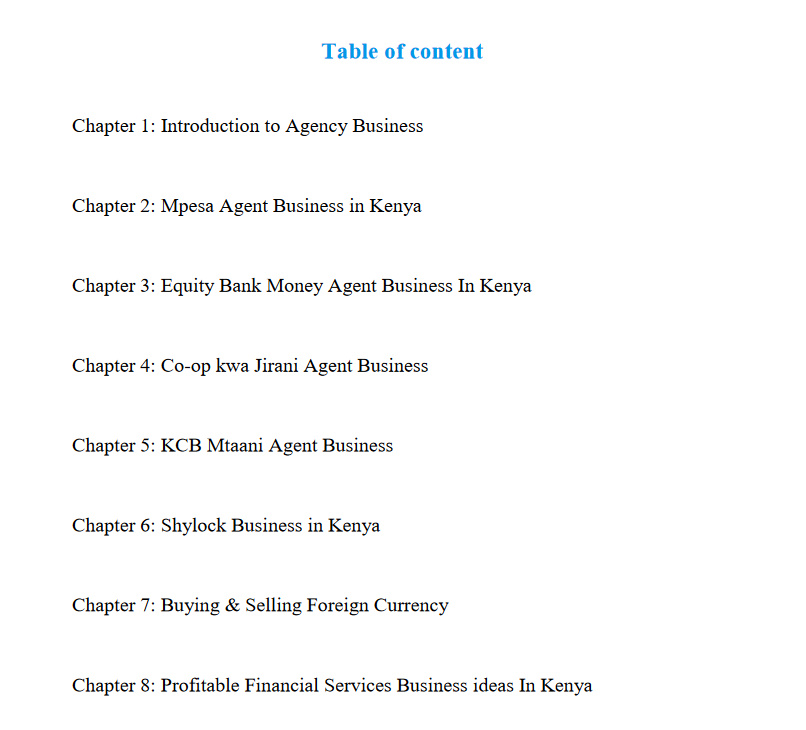

Money Agent Business Plan

Money Agent Business Plan

Money Agent Business Plan Overview

This Money Agent Business Plan refers to the business of the delivery of financial services to customers by a third party on behalf of a licensed bank or mobile money operator (Principal). he third parties (agents) are non-bank retail agents who rely on technology such as:

- POS (point-of-sale) terminal

- Mobile devices

- Card readers.

How Do I Start the Agency Business?

If you are already running an enterprise, such as a Pharmacy,, hardware shops or retail stores you are eligible to become a banking agent. This way you can supplement your income and increase customer traffic to the core business.

So What Is Required Of You By The Bank?

The requirements are almost the same across the main Kenyan banks. They include:

- The banks expect you to have an enterprise that is strategically located and has the capability to serve multiple customers.

- The enterprise must have the required licenses and you are expected to attach copies of your PIN and business permit. In addition to this, one needs to gain the CBK (Central Bank of Kenya) license approval. It costs Ksh.1,000.

- In order to qualify, the business should have been in operation for a minimum period of 12-18 months.

- You have to attach your account statements, certificate of good conduct, copy of ID, resume and two passport sized photos.

- You must reserve anywhere between Ksh.50,000 to Ksh.100,000 as initial float for the agency enterprise.

Once your application is approved, the bank will provide you with a PDQ machine and you can proceed to begin agency banking services.

What Support Does The Bank Offer An Agent?

As you go about the agency business, the bank will support you by offering services such as:

- Free training to you and employees who will assist in running the agency business.

- Transaction statements will be provided upon request.

- The bank gives you access to customer care services and the 24 hour help desk.

- The bank officials will regularly visit your business to check on your progress and listen to your concerns.

How Do You Make Money as Money Agent?

Your income in the agency business will be derived solely from commissions on transactions processed through your outlet by bank customers. The commission is shared between you and the bank as defined in your revenue share agreement.

The commissions are charged on utility payments, balance inquiry, cash deposits, mini statements and many more. They are credited to your agent commission account and depending on your choice; statements will be issued monthly or after a long period.

Download Money Agent Business Plan / guide here