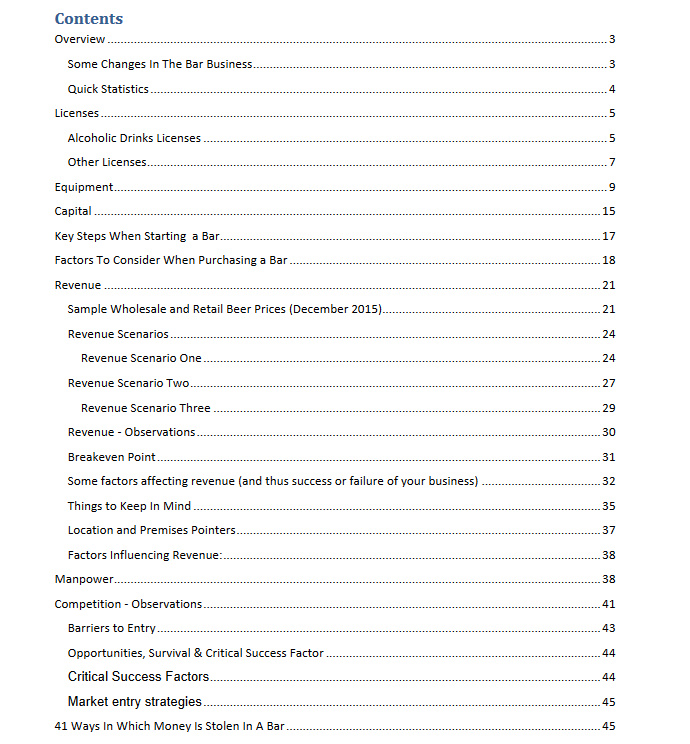

Local Bar Business Plan

Local Bar Business Plan

Local Bar Business Plan Overview

The first version of this Local Bar Business Plan focused on what has traditionally been the ‘local’ bar: the local neighborhood bar, small with a sitting capacity of the 10 to 40, an element of casualness and where everybody knows everyone.

Though this bar still exists the local has also come to mean large bars (over 100 sitting capacity), more professionally managed and which are not just patronized by consumers from the neighborhood. These are the kind of bars which traditionally used to be destinations for weekend outings. The larger kind of bar have sprouted in urban estates making them almost as ubiquitous as the small ‘locals’.

Another shift has been towards ‘hip’ locals; neighborhood ‘lounges’ where significant amounts of money are invested in the interior design and creating an impression of modern, chic and trendy.

The evolution of the local has been driven by access to large amounts of capital by some entrepreneurs, the attraction of scale as a way to succeeding fast ( shock and awe strategy aimed at attracting attention and intimidating competition) , changing drinking habits for instance bar hoping ;moving from bar to bar within one drinking session, consumers search for better experiences at relatively affordable costs among other reasons, the need to differentiate as a result of increased competition in the business.

This Local Bar Business Plan will give insights which cut across the different kinds of ‘locals’.

Some Changes In The Bar Business

There has been a couple of significant changes that have affected the bar business:

- Crackdown on Wines and Spirits outlets: This largely happened in 2015. In addition to literally destroying wines and spirits outlets in some regions especially Central, Eastern and Nairobi there were efforts to criminalize drinking alcohol. Some counties even declared they were not going to issue any more liquor licenses. The crackdown seems to have lost its steam.

- Increased number of bars: Bar business has become one of the most popular to start, and thus bars have sprouted all over. And as expected the casualty rate; the number of bars closing down has also increased.

- Increase in number of higher capacity bars: Larger capacity bars with sitting capacity of 100 plus are now more common, not only in selected ‘out of town ’ locations and along highways but also in estates.

- Fall and rise of Senator Keg : Due to changes in the tax regime, the fortunes of Senator Keg has fallen then risen recently ( 2015) again due to reduction in tax and the crackdown on Wines and Spirits. There had been efforts to capture the Keg and Spirits customers by promotion of low end beers but there has been any significant shift of the consumers.

- Alcohol blow : Alcohol blow was reintroduced in 2014 in Nairobi and some other urban centers. For a period this changed the drinking habits with some motorists preferring to drink near home, reduced bar hopping and moderating drinking a little bit. Nowadays consumers have learnt to play cat and mouse with police and National Transport and Safety Authority (NTSA) officials.

- Among a section of consumers, those with income of Kshs.70, 000 and above Alcohol consumption in urban areas growing despite relatively high inflation rates – This has been attributed by such consumers being more aspirational, living for the moment, wanting to belong (peer pressure), show off and eventually spending more on leisure.

- Though still debatable the economic is perceived to be expanding and with it the so called mid class who is urban, has access to credit, ambitions and seeks a more comfortable and entertaining life. This fuels the entertainment industry.

- Tax on beer : Every year the tax on alcoholic drinks has been revised upwards, of course resulting in higher beer prices. Interesting is that as the beer prices increase bar owners are raising their margins at a larger proportion. (For instance if before a price increase the margins were 20%, after a rise the margins shoot to 30 % and so forth…). The last change was in November 2015, when the excise duty rates on alcoholic drinks were increased.

- Rise in premium beers : Consumers opting for premium beers have been on the increase

- Micro breweries (Craft Beers) : Though the micro breweries hasn’t recorded major changes there is a growing interest among investors and consumers in craft beers. In addition Brew Bistro and Sierra there is Sirville , at Galleria Mall, Langata. The latter was established in 2013 and has grown to over annual revenues of Kshs.70 million. There is also talk that more micro brewers might be hitting the market soon.

Download Local Bar Business Plan / guide here