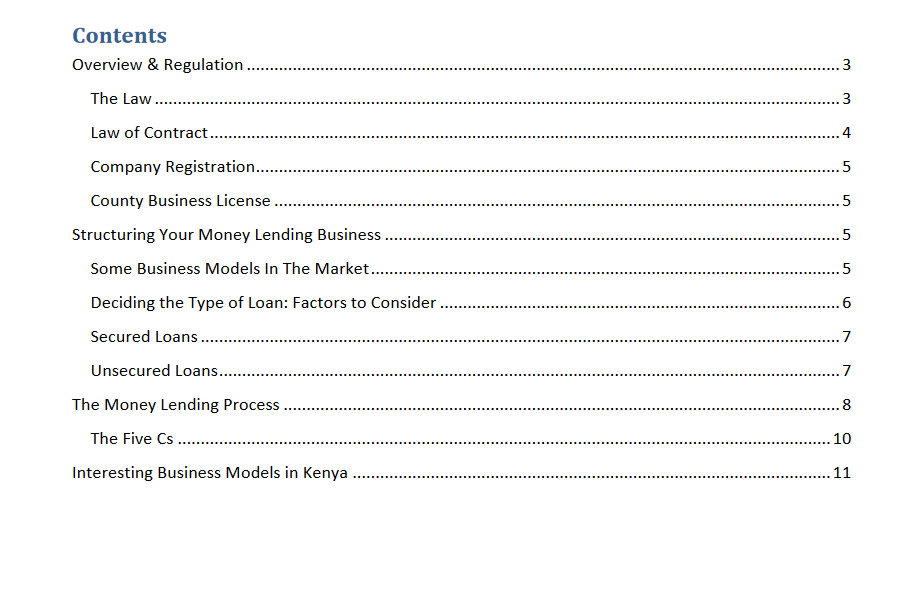

Informal Money Lending Business Plan

Informal Money Lending Business Plan

Informal Money Lending Business Plan Overview

This Informal Money Lending Business Plan refers to the semi formal and informal lending of cash. You know the chama lending money, office groups or individuals lending to colleagues, shylocks, and the many XYZ Capital and other such entities. In a more positive way there are known as alternative sources of credit. Alternative from the traditional sources such as banks and Saccos.

The reason we refer to them as semi informal is because they are largely unregulated. There is no law per se which regulates money lending that is if the person or organization lending money is not taking deposits.

The Law

The two laws which are the closest to the business are the Banking Act of and the Microfinance Act of 2006. The laws are only applicable to institutions taking deposits: According to the latter act “No person shall carry out deposit taking business without a valid license. “

Among the requirements to get licensed as a deposit taking microfinance institution are:

- Incorporation of the words “Deposit Taking Microfinance” or the acronym “DTM” in their business name;

- The ‘Fit and Proper’ Test of the professional and reputational suitability of persons proposed to manage or control an institution.

- Feasibility study and three-year business plan of the proposed deposit-taking business in Kenya, detailing the mission, vision, scope and nature of business operations, profitability analysis and internal controls and monitoring procedures…

- the applicant’s risk-management policies and internal control systems including, among others, board and senior management oversight, internal controls, physical infrastructure, geographical presence, use of information technology…

There are many other requirements including on opening branches, operations and finances which we won’t go into at this point because ( Microfinanace Institutions are the subject of another guide all together ). The license is issued by the Central Bank.

A deposit taking microfinance is thus different from the money lending we refer to in this Informal Money Lending Business Plan. The latter is unregulated. The bland view is that the government needs to encourage deposits (deposits are savings, and savings lead to investment. Such institutions which aggregate money make capital available in form of credit) and to do so it has to protect deposits. And how does it do that? By making sure that the organizations taking deposits operate in such a way that the deposits are safe and the deposit taking institutions do not collapse or run away with cash.

There seems to be no such sense of urgency and need to protect those taking credit. Indeed until recently the financial institutions customer who takes credit was not protected. The non deposit taking lender is also not out rightly protected, after all, the reasoning may go: it’s your money that you are risking and the government has no business coming in between. The borrower also willingly agrees to the terms of the creditor and thus does not need any special protection. This state of affairs will not necessarily remain so; there are already signs that a law will eventually be enacted to regulate the money lending business.

Download Informal Money Lending Business Plan / guide here